The finance sector rises to meet its latest cyber security challenges

The finance sector is required to have one of the most sophisticated cyber security postures in the world, with bureaus, banks, finance companies and insurers working closely with their technology partners to ensure sensitive financial data is managed, stored and transferred, with a stringent range of international security standards that must be adhered to at all times. However, cyber criminals have demonstrated repeatedly that they are constantly working to breach even the most sophisticated security ecosystems, devising new ways to exploit both technological vulnerabilities and human error.

Cyber crime escalates throughout the global pandemic

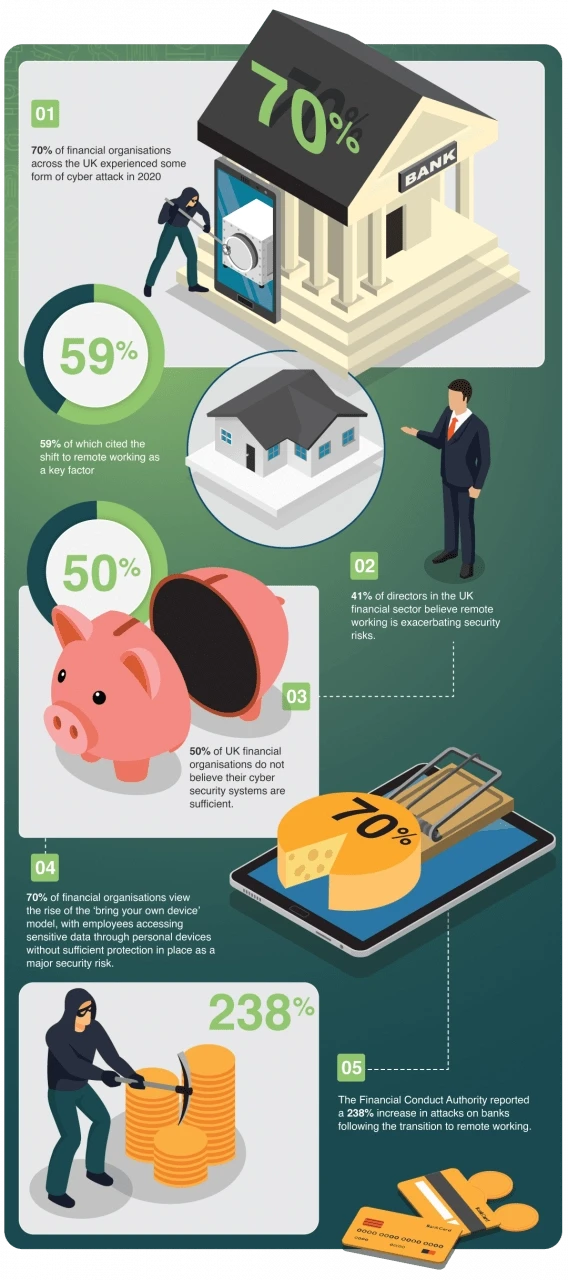

The move to a distributed workforce in response to COVID-19 demonstrated this, with criminals rushing to take advantage of any security vulnerabilities created by the rapid transformation of many organisations' infrastructure and the normalisation of remote working, as demonstrated by the following statistics[1]:

- 70% of financial organisations across the UK experienced some form of cyber attack in 2020,

- 59% of which cited the shift to remote working as a key factor

- 50% of UK financial organisations do not believe their cyber security systems are sufficient

- 41% of directors in the UK financial sector believe remote working is exacerbating security risks

- 70% of financial organisations view the rise of the 'bring your own device' model, with employees accessing sensitive data through personal devices without sufficient protection in place as a major security risk.

- The Financial Conduct Authority reported a 238% increase in attacks on banks following the transition to remote working[2]

It's clear that the finance sector as a whole must take its cyber security systems to the next level to counter these threats, as the consequences of security breaches are invariably serious, in terms of both the loss of sensitive data, financial repercussions, and long-term reputational damage. Cyber security experts have recently predicted that the year ahead will be a challenging one for the finance sector as a whole, with extortion-based attacks – DDoS and ransomware in particular - rising further in frequency[1], with the increasing popularity of cryptocurrency transit amongst cyber criminals making recovering funds lost in such attacks even more challenging

So how can the finance sector prepare itself for these threats, and retain its customers confidence in the months ahead?

Fortunately, by taking a proactive approach to cyber security, financial specialists can protect themselves from the latest threats, without compromising their inherent flexibility and agility in the new era of remote working. We would recommend the following as part of their wider security posture, and work with a trusted cyber security partner with experience in the management of financial data to optimise your infrastructure.

- Make Cloud security a priority. Cloud solutions - both data access and storage - represent a major attack vector for cyber criminals, which means Cloud security should be a key part of any effective cyber security strategy.

- Automate your software patching. Outdated software represents one of the biggest opportunities for cyber criminals. Automating software patches eliminates the risk of human error here, ensuring security vulnerabilities can be resolved as soon as they are detected.

- Do not neglect the risk of human error. Social engineering - the practice of coercing employees to provide access to sensitive data - is an increasingly common tactic amongst cyber criminals. The answer is ongoing education for employees at all levels about data security best practice and all applicable compliance requirements. By developing a security-centric company culture, such risks can be minimised.

Cyber security threats are constantly evolving, but so are the solutions to counter them, including Exponential-e's own Cyber Security Operations Centre. Even for challenging sectors, like finance, tailored solutions and an increased speed of innovation are allowing forward-thinking organisations to stay one step ahead, providing customers with complete peace of mind that their data is secure.

- https://uk.finance.yahoo.com/news/70-percent-uk-finance-industry-hit-with-cyberattacks-in-2020-000851797.html?guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAHsQD8H4xALPBz3JJbRXpf2MzAS88agK2LSqCSgkhIeLxMWLxMQ0fLoETX3pN2opbSSr1IHyBFQv2mIsU0vllXmQnNqJaUFgo-nWh20x92yKOB-yAxe4zboMeHWLIz57rrsTGQrZtjdOepq_Sx91-POFJ63hIoxAfSpThQpPsnrg&guccounter=2

- https://www.infosecurity-magazine.com/news/attacks-on-banks-spike-238-during/

- https://securelist.com/cyberthreats-to-financial-organizations-in-2021/99591/

- https://www.information-age.com/kaspersky-releases-financial-threats-vision-for-2021-123492872/

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.